December 19, 2023

The latest research, market indicators and trade summaries from Sungarden Investment Publishing

ROAR Score

(Return Opportunity and Risk)

If my choices are stocks and cash, what % would I have in the stock market right now?

ASK ME ANYTHING: an ETFYourself live event this Wednesday

December 20, 4:30pm ET

Agenda:

Rob’s brief updates on markets and ongoing enhancements to the ETFYourself.com site

Your questions…answered

Ask me anything: about markets, ETFs, what you want to see on the site, what you don’t understand, what you want to understand more about. Anything!

Registration Link HERE

Survey Says…add to Learning Center…so we did!

Thanks to all those who responded to our subscriber survey! If you haven’t, we’d truly like you to complete it now. We have had some great suggestions, and to show you how quickly we aim to respond, we have already made enhancements to the site, directly in response to survey responses. You can find both under the Learning Center tab.

We added a post that summarizes my 10 best educational articles of the past year, with a quick description and link to each article.

My presentation to the Money Show last week is now in video form, and we’ve posted it to the site.

Here’s a LINK to the survey

We need much more feedback on things like:

Should we add more lists of things that are buyable but I just don’t have enough room for all of them in the portfolio? That might produce something like a top 15 or top 20 or something like that.

With modern markets rendering so many ETFs and stocks as “risk on” or “risk off,” is my list of nearly 200 ETFs overkill? If so, I could cut the list to 100 in a “heartbeat” for easier tracking. Those would be the ones considered for the models, but we’d have a supplemental ETF list that we cover but don’t currently consider for the models. Sort of like when I go to a nice restaurant and the wine list has Merlot, Cabernet, Chianti and “Other Interesting Reds” if you know what I mean.

There’s an open space at the end of the quick survey to answer these questions and anything else you want to tell us. We read every one…at least twice.

Market in a Minute

Last week, I wrote here about 3 possible scenarios for 2024, each based on previous periods I lived through and invested through. It is worth repeating them:

2000: QQQ rises sharper and faster than anyone can imagine, and that is the final “blowoff top” of this post-pandemic era.

2008: 2023’s regional bank crisis was swept aside like Bear Stearns’ failure was in 2007. But that only led to a worse situation in 2008 involving banking and consumer woes.

2010: Remember investing in 2010? Few do. It was not as memorable as the 2 cited above. But 2010 followed the vicious 37% S&P 500 decline of 2008 and the 26% rebound in 2009, like 2022 and 2023. The S&P 500 gained 15% in 2010, but it was a back and forth year, with that entire return coming in the final 4 months.

We won’t be able to declare that the market is surging toward one of these scenarios immediately. But we can note when hints of them appear. The current stock market action looks more like 2000 every day, with the drek flying higher in price and the quality lagging behind. That’s just a quick observation. January will tell us more than late December. It typically does.

I recorded my monthly guest appearance on Seeking Alpha’s Investing Experts podcast today, so I’ll give you a short preview of what we covered:

The past 2 years netted out to zero in much of the stock market, making 2024 the tiebreaker year, of sorts. 2024 should be the year that dictates whether the next several years will be bull, bear or just plain old frustratingly stagnant for stocks. And bonds/rates will either keep pretending they are stocks (volatile!) because inflation is “solved”…then turns out to not be, or because we slide into recession and the Fed lowers rates in a hurry, but it is likely of little help (too late!).

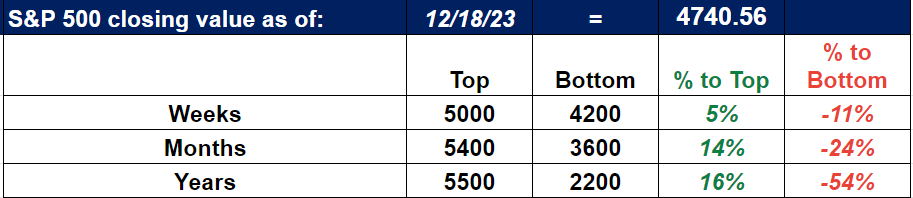

My short term range for the S&P 500 has been lifted from 4,600 to 5,000 That index, still powered by the “Magnificent 7” stocks, crossed one line in the sand, but I’m still in “show me” mode, looking for a decisive move to 4,900-5,000 to really get behind the “new bull market” narrative. But I’m thrilled to tag along for as long as the momentum crowd wants to run the stock market higher. Just don’t put me in the “all-in” crowd.

I try not to spend much time predicting the future, since the market tells us a story all the time. Right now, that story is more intriguing than usually is at year-end. Why?

T-bills are still yielding 5.50% at the shortest end and 4.95% for 1 year. That and the yield curve inversion threatening to re-write the record books are cause for concern, even if that risk is not realized right away.

QQQ is at an all time high, SPY is nearing one, and IWM is at the very top of a price range it has been in for 20 months. It all adds up to a great time to let the market tell us what it wants to do. The last time that happened, the ROAR Score finally moved up from its 2-month home at the 10 level, to 25 and then to 35 last week.

This is a good example of how, at least in my view of investment strategy and risk management, long-term investing requires a series of shorter-term moves. I have always believed that is better than just hoping that the market does well because it usually does. That’s guessing. And I’d rather strike an ongoing balance between reward and risk, and use the wide array of tools that ETFs offer to construct modern portfolios.

The plan:

Our ROAR Score stays at 35, where it moved up to last week from 25, after 5 straight weeks at that lower level. Our 2-ETF model portfolio is 35% in SPY (S&P 500) and 65% in BIL (1-3 month T-bills).

ROAR has not been above 40 since August of 2022, back when the S&P 500 was around 4,300. It was there again about 6 weeks ago, so a low ROAR Score in an era of high T-bill rates worked out just fine. Heck, RSP (equal weighted S&P 500 ETF) is still only up 3% from August of last year.

This reminds us that 2023 was more of a recovery year from 2022 to get back to even, not the start of some giant new bull market. But enough of the market is undervalued, and bond market behavior so erratic, that it potentially sets up for some nice entry points in 2024. But Rob, don’t get ahead of yourself! Let the market tell its story.

ETFYourself.com is new, but the investment process behind it has evolved over the past 3 decades. You bring the desire, we'll provide the tools!