ETFyourself.com: NEW Sunday Edition

Chart of the week, performance updates and more

Updating our Thursday & Sunday format

What we are removing from Sunday:

My articles on etf.com can all be seen by clicking the link below at any time to go to my author page there. So we will no longer list them each week, and just post that link every Sunday as a reminder.

We’ve removed the links to other commentaries

What’s new:

Thursdays (and a “bonus” one today)

CHART OF THE WEEK: I pick one chart I think is the most interesting going into the new week, and “bottom-line” why I think so.

Sundays (starting today)

PERFORMANCE THAT MATTERS: We’ll update a custom table we created to help our subscribers analyze performance THE RIGHT WAY, not the lazy way promoted so heavily by much of Wall Street, usually to help sell products.

Sure, we’ll provide some “standard” periods for several major asset classes via ETFs that represent them: Year to date, 3 year

HOWEVER, The real value in past performance is in analyzing it from key points in the market cycle, not static return periods. This is information we do not think is easily found elsewhere. But you’ll find it here, every Sunday. The 2 periods we’re focusing on are: since the start of 2022, and since the pandemic top back on 2/19/2020, as well as the biggest decline from peak to trough since that latter date.

ETFYourself.com’s chart of the week

(Special Sunday chart - because this is one interesting market…)

One thing I clearly remember about early 2020, just before the pandemic became reality and this index, the S&P 500, fell 33% in 5 weeks, was that the trouble showed up in the charts before the panic hit the market. And as a chartist, what I try to do is measure and monitor risk, not predict the future. So when I see a chart that is as threatening as this one is, I want folks to see what I see.

Top of chart

Broke down from steep uptrend in place since October (purple lines)

20-day moving average threatening to roll over (yellow line)

Generally weakening price action (ovals, today and past similar cases)

Bottom of chart

Rectangle at right is the #1 cue for me, showing a clear drop in momentum

This is like the S&P 500 tapping the brakes, don’t know if it will stop the car

This is a pattern I see before virtually every decline of substance. The past 2 shown only resulted in 8% declines. But today, the markets are dealing with a lot more (inflation, geopolitical, election, etc.) and is coming off an historic up move.

This will be a week of activity for sure

Performance That Matters

This is the first edition so take it all in. Each Sunday I’ll put a few comments in, like this:

Conservative Allocation (AOK) has provided very low positive returns since the start of the pandemic. If inflation is not tamed soon, this could continue.

The average stock in the S&P 500 has gone virtually nowhere since the start of 2022, up 1.5% per year. This shows just how much the US market is relying on a small number of giant stocks.

Source for all data: Ycharts

Rob Isbitts on etf.com

You can see my full history of articles for etf.com on my author page here.

Our favorite podcasts

Visit our Learning Center tab at ETFYourself.com, where we have links to our favorite podcasts. We’ll keep building the list as we find and like them!

People don't know what they want until you show it to them - Steve Jobs

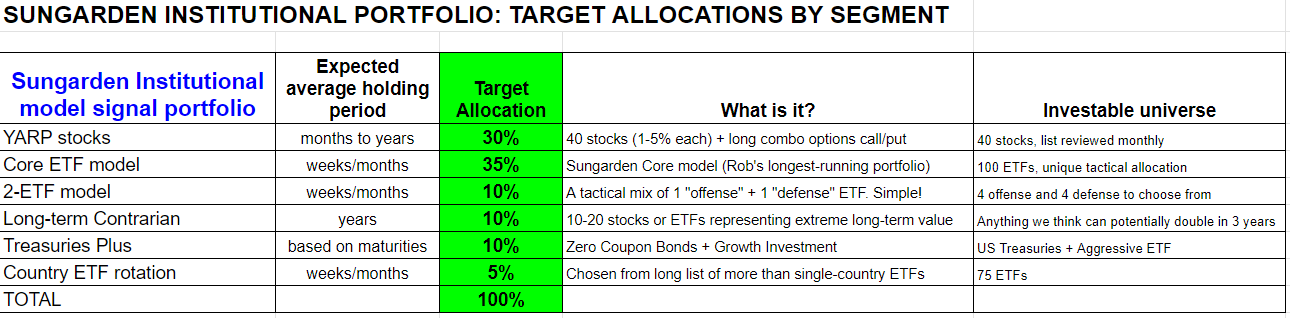

The Sungarden Institutional model signal portfolio

Direct access to a portfolio separated into 6 “buckets”

This is what I’m doing with about 85% of my liquid assets

Who is this for?

High net worth, self-directed investors looking for more help, less hype

Investment advisors seeking a research engine and efficient access to an OCIO

Institutional investors who want a true “alternative” to mainstream approaches