ETFyourself.com: Sunday Edition

Chart of the week, performance updates and more

What a week for podcasting!

I participated in 2 Seeking Alpha podcasts that posted this week.

Tuesday, I was a guest on Seeking Alpha's Investing Experts podcast, interviewed by SA podcast guru Rena Sherbill. I always get a lot of insight into how investors are thinking when I see the download numbers and questions folks ask in the SA comments section after they hear it. This much is clear to me:

Many investors do not want to hear as much about playing defense as they do playing offense and making money “now.” My most successful article in the 2 years I’ve been publishing on SA was recently, and it was about a highly speculative new fund that I said I’d gladly invest in…with a whopping 0.5% of my assets. And I did. But I suspect that the “position sizing as a key to the defensive side of the portfolio” was lost on a lot of people.

For you, our subscribers: congratulate yourselves

You’ve come to the right place, and you found us by signing up to receive information from us each week. That means you care about the “defensive side of the ball” as they say in football. Good for you, you are way ahead of your peers in being prepared if the future does not replicate the recent past. And if you know anyone in your circle that is of similar, offense-defense mindset when it comes to the money they’ve accumulated, let them know about ETFYourself.com.

The other podcast was truly a thrill and “bucket list” item for me. I hosted a Seeking Alpha roundtable podcast, which gave me a chance to feature the outstanding work of 4 young investment analysts, each of whom has a keen sense for their area of specialty. Have a listen!

Performance That Matters

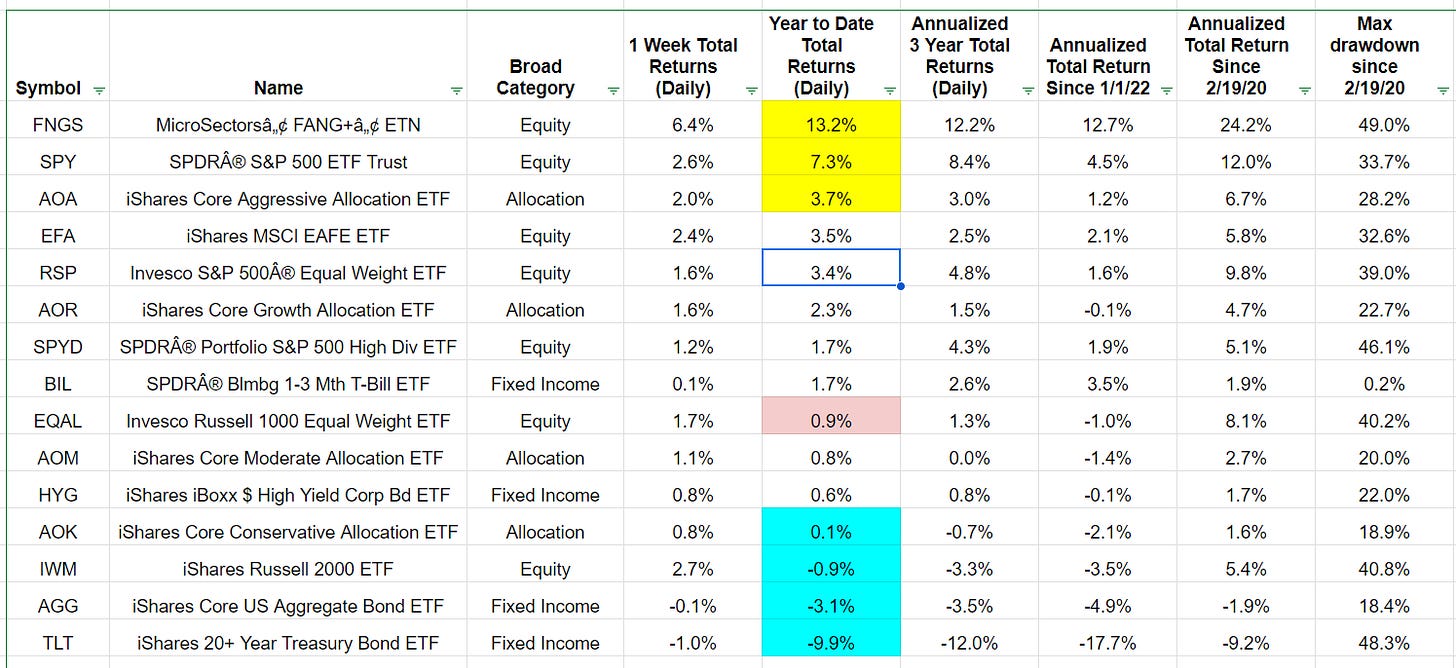

It is getting to that point in the year where “year to date” performance starts to have some meaning and trend. Here’s what I see:

(yellow section): SPY is up more than 7% in 4 months, and FNGS (FANG stocks) have produced above-average returns, continuing the move that started last Halloween. It is getting volatile and earnings season is not over, so this will likely be a moving target the next few weeks. This is why I despise earnings season :-)

(blue section): but as has been the case more often than not, bonds are lacking and so are small caps. The higher rates go (and they do look poised to go higher), the worse this could get. “Conservative” investors (symbol AOK) are not A-OK and have not been for years. This has caused many to “reach” for risk assets (stocks and other stuff), which works well, until it doesn’t.

(pink section): the average stock of the top 1,000 is up less than 1% this year, and has a 3-year annualized return of 1.3%. Bull market? Depends who you ask.

(blue boxed data point): The equal weight S&P 500 (RSP) is up 3.4% this year, and that’s solid. However, when you consider that it is less than half the return of SPY, it tells us loud and clear that this is not yet a sustainable “widening” of the market beyond a small number of big stocks.

Do you like this Sunday edition? How about the Thursday edition, which is more chart based? Should we combine them? We are considering all types of enhancements to ETFYourself.com including:

A daily chart - short and sweet, a picture and a short paragraph

A streamlined “offense-defense” watch list depth chart, taking the ROAR Score to the next level. Multiple version of the ROAR (short-term, intermediate-term, long-term), simplified “offense and defense” sections, with a list of potential ETFs and stocks to fill those 2 sections. In other words, greater focus on “what we like” in ETFs and stocks, and less on “portfolio construction.

LET US KNOW WHAT YOU THINK (via the chat or email to info@etfyourself.com)

Rob Isbitts on etf.com

You can see my full history of articles for etf.com on my author page here.

Our favorite podcasts

Visit our Learning Center tab at ETFYourself.com, where we have links to our favorite podcasts. We’ll keep building the list as we find and like them!

People don't know what they want until you show it to them - Steve Jobs

The Sungarden Institutional model signal portfolio

Who is this for?

High net worth, self-directed investors looking for more help, less hype

Investment advisors seeking a research engine and efficient access to an OCIO

Institutional investors who want a true “alternative” to mainstream approaches

EXCELLENT feedback. We are taking it all in, and will roll out the enhancements in the near future.

Thanks, Donald! This is what we need - for folks to tell us what they want and see if a consensus can be built around anything we do, so I can focus my efforts on the analysis.

In order to really make ETFYourself a top-tier publication, we feel we need to "rally around" my "very best thinking, and do so efficiently for all concerned. Many investment subscription products are run by greedy, self-serving types just trying to make a sale. Not here.

We are in this to make an impact. Otherwise we have plenty else to do in our semi-retirement phase of life. But we are encouraged by all those who have stepped forward and told us what they like or what they want, so thanks!

Still gathering feedback for a bit longer, but this is what we've come to understand so far, what is most valuable and dovetails with best use of my research time:

1. ROAR in multiple forms (so folks learn portfolio balance between offense and defense over time)

2. Watchlist/depth chart of eligible ETFs (i.e. those I am considering for use on offense or defense "at the right price"). This is at the ETF level, no consideration for what my or anyone else's portfolio will do with that info. Short summaries of why I'm following each ETF.

3. ETF charts/quick comments to tell market story with fewer words and more visuals (so folks learn charting over time). Thinking about 1 chart every weekday plus Sunday, and Tuesdays will continue to be the "big" day each week. However, it will be the same chart-headline-quick notes each time, just with premium subscribers getting several more (5-10) each week, and a watchlist for premium subscribers that essentially points out which ETFs are "at the tails" of my analysis. That is, which ones look very good or very bad, and the rest are unremarkable.

4. That 7-ETF portfolio, which is more educational than anything, since the overwhelming response we get from subscribers is "tell me what looks good or bad and I'll take it from there." That's perfect for us, since I left the advice business 4 years ago. And since my own investing can be very proactive at times and use options and other wrinkles to try to protect/enhance gains and income, I don't see how we can translate all of that for any less than $300 a month, which is the Institutional service.

So we'll finalize these service improvements, and also determine if the current $40 a month/$400 a year should remain or possibly be lowered, since we will be streamlining a lot of this. More on all of this soon, thanks!