ETFyourself.com: Sunday Edition

Chart of the week, performance updates and more

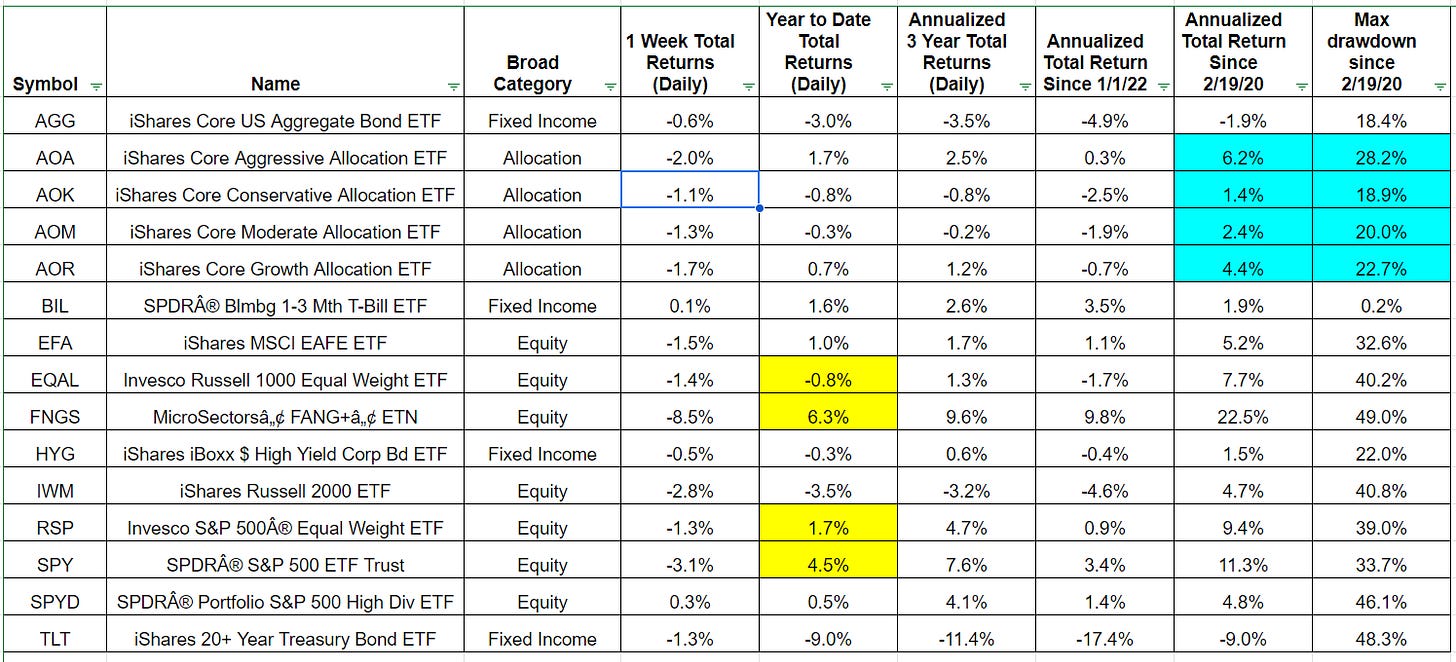

Performance That Matters

When I debuted this table last week, the year to date return for FNGS, the Magnificent Seven Nasdaq stocks plus a few more like them, was flying in 2024. What a difference a week makes, topped off by the 10% drop in Nvidia on Friday. Result: FNGS now up 6% for the year, off a peak of +18% not long ago.

Lesson: past performance can be deceiving, and the more we chase it “just because it went up,” the more we are flying blind. That’s one reason I do what I do, and communicate these ongoing educational points. Because I continue to see too many investors chasing performance, rather than doing research.

But this is not simply a Nasdaq problem brewing. As shown in yellow, the average S&P 500 stock (RSP) is now only up 1.7% YTD and when we add in the next-largest 500 stocks (EQAL), the average stock is down 0.8%.

Looking back further (blue highlights), an asset allocation portfolio, ranging from conservative to aggressive, continues to be in a rut that is now more than 4 years old. A conservative mix of 30% stocks/70% bonds is up only 1.4% since the pandemic peak in early 2020. This is why I tend not to use terms like “bull market” or “bear market.” It is a low return market with lots of volatility, but people fool themselves when they listen to folks on TV or on social media touting big returns.

Lesson: put it all in context. That’s what this table aims to do: provide context.

FINAL NOTE FOR NOW: after a week like this, when many trends were broken, I strongly encourage ETFYourself.com subscribers to re-visit our recent issues, which are all currently on the site’s homepage, published on April 14, 16, and 18. Here is the chart of the S&P 500 I posted last Sunday, not the first time I’ve tried to get our subscribers out in front of what appeared to me to be a high-risk stock market, driven in large part by rising interest rates and excessive optimism.

Again, I do not care which direction the markets go. My goal is to make money as consistently as possible, and the #1 way to do that is by learning how to play defense, a skill many investors never learn...because no one has a vested interest in teaching it to them. I’m teaching it at ETFYourself.com and through our Sungarden Institutional service.

Source for all data: Ycharts

Rob Isbitts on etf.com

You can see my full history of articles for etf.com on my author page here.

Our favorite podcasts

Visit our Learning Center tab at ETFYourself.com, where we have links to our favorite podcasts. We’ll keep building the list as we find and like them!

People don't know what they want until you show it to them - Steve Jobs

The Sungarden Institutional model signal portfolio

Who is this for?

High net worth, self-directed investors looking for more help, less hype

Investment advisors seeking a research engine and efficient access to an OCIO

Institutional investors who want a true “alternative” to mainstream approaches

clever