"Good Luck Hunting"

Iconic movie reminds me of the current market for bullish investors

Let me tell you what I do know; every day, I come by your house and I pick you up. And we go out, we have a few drinks, and a few laughs, and it's great. You know what the best part of my day is? It's for about ten seconds when I pull up to the curb to when I get to your door. 'Cause I think maybe I'll get up there and I'll knock on the door and you won't be there. No goodbye, no "see ya later", no nothin'. You just left. I don't know much, but I know that.

That speech was delivered by Ben Affleck to Matt Damon in a memorable scene from the 1997 hit film “Good Will Hunting.” Periods like the current one in the stock and bond markets, remind me of that scene, even though the context is completely different. He was hoping his friend would go pursue his dreams, and leave the surroundings that constrained him.

I just keep looking every day for something that might make for a good “offense” position at a time when “defense” is all that looks good. But every day, I show up to look at my charts. And every day, its the same thing: no great ideas on the traditional “long” side of the stock market.

Remember, we try to play both at the same time. And this is a particularly nice time to understand how to manage using that approach. Because any market contains profit opportunities, and you don’t have to be a day trader. You just need to marry offense and defense under the same roof, and learn to rotate between them. Not in an all or nothing fashion, but side by side.

In a market environment like this, the impulse reaction for many investors is to “find a good stock to buy.” Yet day after day, prices drip lower, for stocks and especially for long-term bonds.

Every day, I look through the 200 ETFs I track. As we’ll show you this week when we post our list of market segments we track via those 200 tickers, it is a very wide range of investment types. But in periods like this, I see the same thing every day: nothing in the stock market that looks good for more than a “bounce.” Bond market? Same thing.

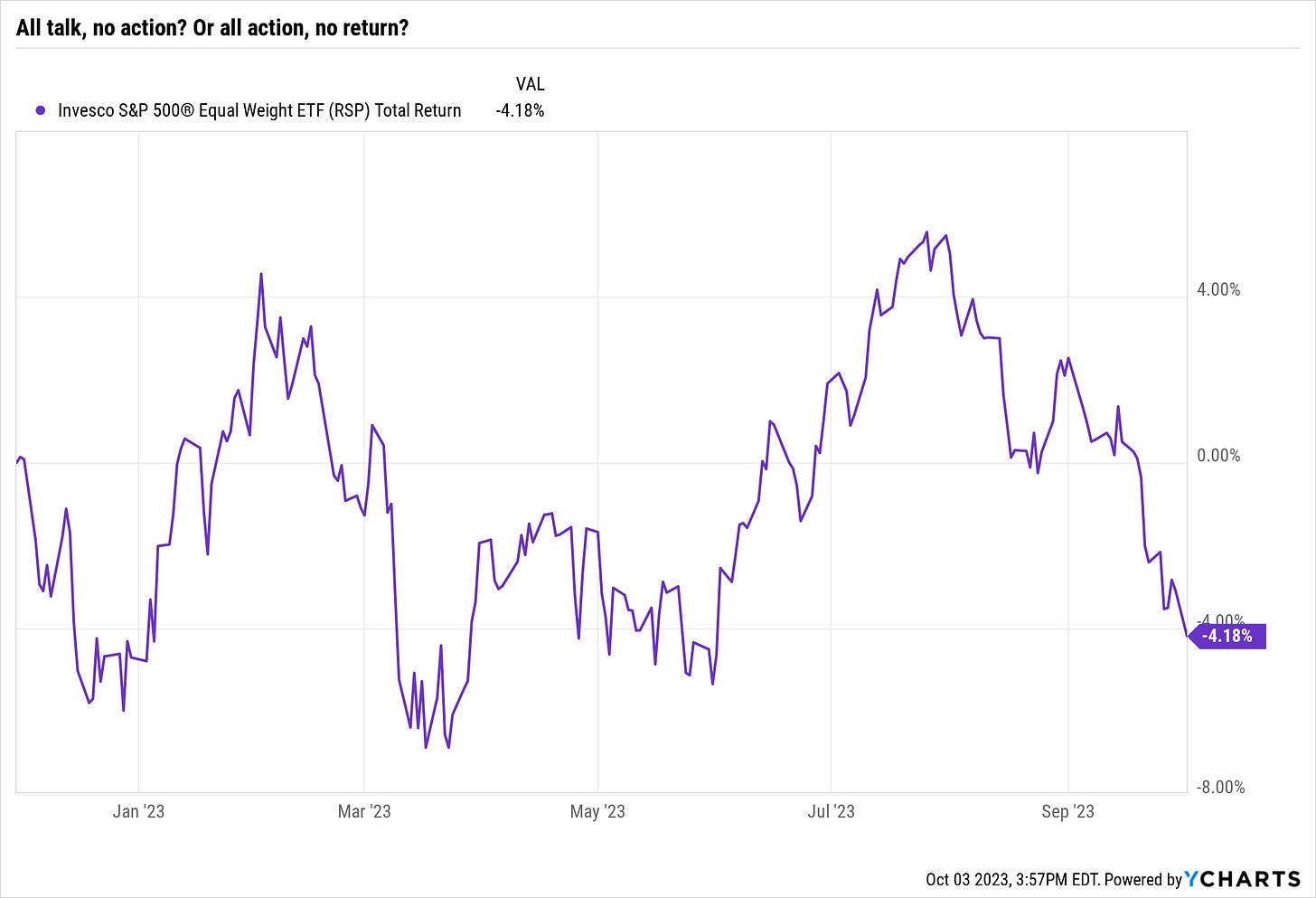

That’s why our ROAR Score is close to zero: I do not believe in taking outsized risk based on a hunch, or “because the market is on sale.” No such thing. The chart below is that of one of those 200 ETF I track, which invests in the S&P 500, but weights the stocks equally, so it represents the average stock. And since the end of last November, there has been action, but no return, while T-bills pay 5% and investing in ETFs that short the stock and bond markets has paid off handsomely. That was especially true in 2022, but here in late 2023, a similar vibe is in range.

But if I’ve learned anything in 30+ years of constant market-watching, it is this: investing is NEVER black or white, its always a Shade of Grey…that’s not a movie reference! Investing in these modern markets is about always looking at how to play offense, and how to play defense. Most often, at the same time.

Finding the defensive ETFs that can protect our model portfolios from major loss, exploit the situation if this dip turns into a crash, and get paid to wait (with T-bill ETF yielding 5%) has been the easy part lately. But like Ben Affleck’s character in that great movie, the highlight of my day is looking at my 200-ETF watchlist, and hoping I’ll find something in the stock market that looks good for more than a very short-term trade. Eventually, it will happen, and suddenly, just like Matt Damon’s character just didn’t show up one day, pursuing his big dreams. But for now, the risk attached to traditional stock market “offense” is just not worth allocating more than a trickle of assets to.

Fortunately, ETFYourself.com is all about thriving in whatever market we have, rather than a market some wish we had. When all is said and done, the market and the ETFs we use to invest, are NOT the end goal. They are means to that end.

Tomorrow, we’ll have some helpful new material on the site, for both free and premium members. It will include more detailed analysis of our ETF watchlist and model portfolios. We look forward to sharing that with you.