March 19, 2024

The latest research, market indicators and trade summaries from Sungarden Investment Publishing

ROAR Score

(Return Opportunity and Risk)

If my choices are stocks and cash, what % would I have in the stock market right now?

Market in a Minute

Major Upgrade To the Premium Research Deck and 7-ETF Portfolio

Earlier this month, we alerted you that we were working on several important enhancements to our service, primarily in response to subscriber requests. First we streamlined the weekly letters, then we bottom-lined our view of the most interesting charts Rob sees each week. And this past Sunday we formally introduced the Sungarden Institutional Portfolio service at www.SungardenInvestment.com.

Today, we are excited to announce that we have strengthened the 7-ETF model portfolio, while simplifying its use at the same time! As premium subscribers will see in the updated GUIDE TO THE RESEARCH DECK tab, and in the 7-ETF MODEL tab, we’ve created essentially a “menu” that allows subscribers to plug-and-play their own mix of 7 ETFs, or follow along with Rob’s selections and rotation among ETFs.

We’ve also cut the list of followed ETFs down to 50, since each of the 7 ETF portfolio “slots” shows 7 different ETFs that might be used in that slot (and BIL, the T-bill ETF is the 50th on the list, to be used in any slot). The 50 ETFs removed from the watchlist now reside in a separate tab on the Research Deck, in case subscribers want to continue to track them.

As we see it, this creates more of a do-it-yourself portfolio tool, but using our ETF research and portfolio model as a guide. We look forward to having our premium subscribers put it to use. And as always, we welcome questions and feedback. We’ll also aim to have an “Ask Me Anything” session on this new portfolio construction tool next week.

Great news for “charter members” of the NEW Sungarden Institutional model signal service

The story and description of our new Institutional-level service is over at our “headquarters” site, www.sungardeninvestment.com.

That portfolio model, which mimics what I do with about 90% of my family’s own liquid wealth, is now up and running!

Members of that service were just sent their initial “shared research deck” which includes everything in the ETFYourself.com deck, plus 2 additional tabs which are the new home for the Sungarden Institutional portfolio.

Coming soon: analytics of the portfolio holdings, so you can look at the portfolio allocation in much greater detail, but not so much detail that your eyes will cross.

Now, on to this week’s Tuesday letter!

What the stock market is “saying” now

The headlines still send a powerful signal that “all is well,” while under the surface, there continues to be a big segment of the global market that is at best stagnant.

This means 1 of 3 things as 2024 continues:

The rest will join in, making for a glorious, inclusive upswing in stock prices

The leaders (Magnificent 7 or whatever they call them nowadays) will roll over and we’ll have a decline of some “Mag-nitude” (see what I did there?)

We’ll have something similar to the year 2000, where stocks do the old “switcheroo”

I lean toward the latter, and here’s why. Of course, my views are bottom-line, chart-based since to me, that has been the best truth serum for managing money professionally for over 30 years.

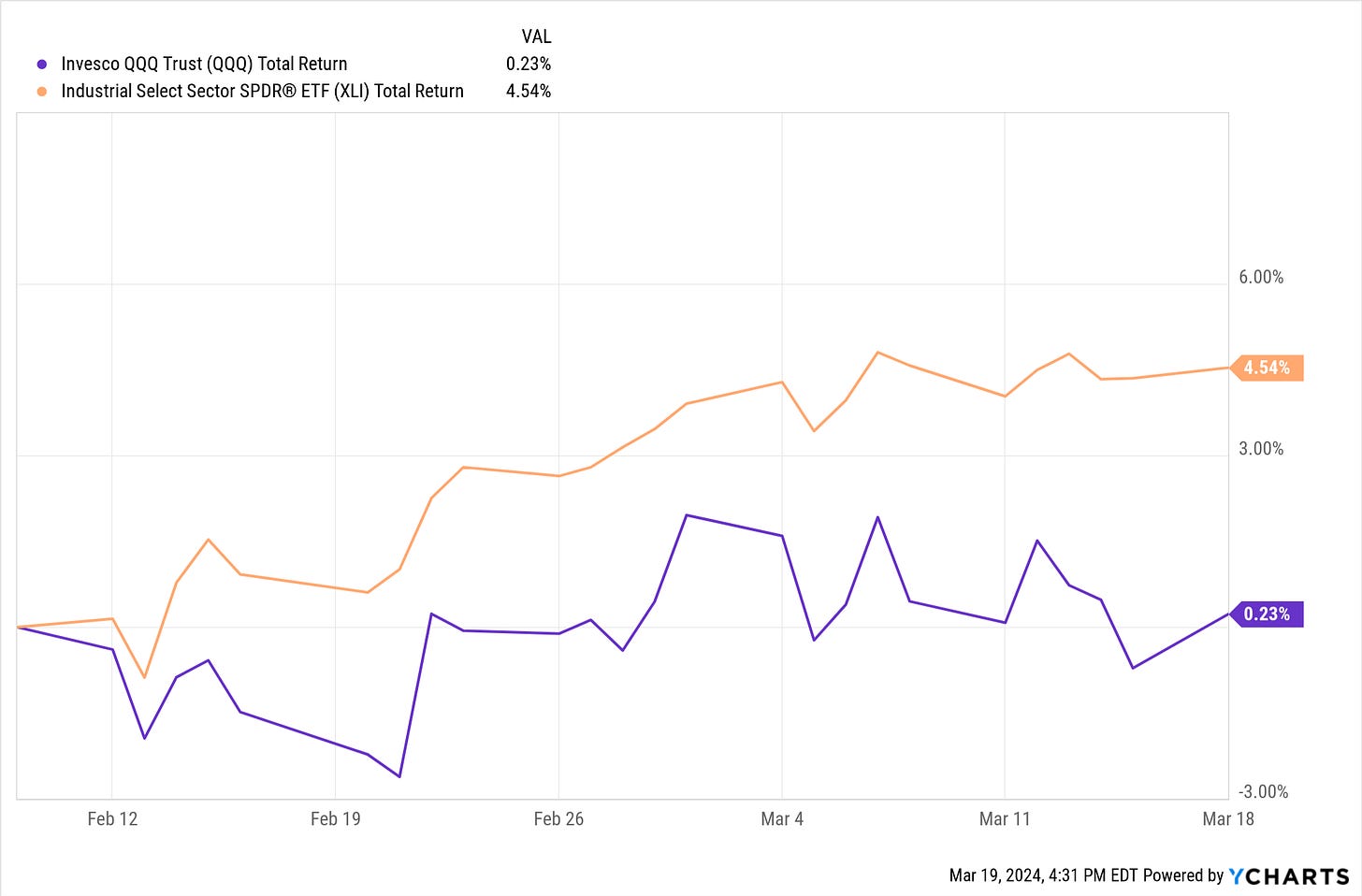

Here is QQQ versus what I’d say is the S&P 500 sector I am most intrigued by, Industrials. By “intrigued” I mean that is filled with solid, tenured US businesses that tend to be consistently profitable and of higher quality. That doesn’t mean I’m jumping in with both feet, but that I am looking carefully for some future YARP stock buys.

See how much XLI, as one example of the “not Mag 7” club, lagged QQQ from the start of 2023 through February 9 of this year.

But quietly, the market might be faintly whispering a change in trend over the past 6 weeks. Let’s see if this one has “legs.” Or, if Powell and the Fed will throw everyone into a tizzy tomorrow at 2pm at the meeting that was supposed to bring the first rate cut, if you had asked the experts while sipping your holiday eggnog a few months ago.

S&P X-Ray

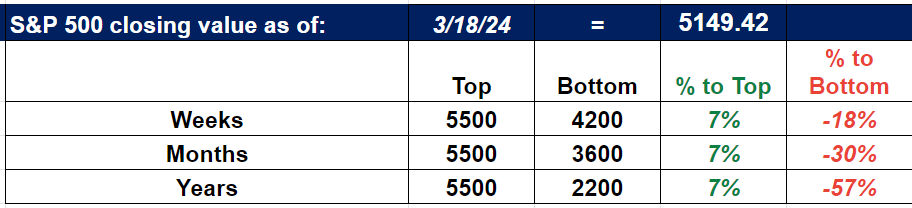

The S&P X-Ray tracks our latest projected trading ranges

for the S&P 500

(Updated weekly on Tuesday, as of Monday’s market close)

The ROAR Score remains at 40 this week. That means my 2-ETF portfolio is at 40% SPY (S&P 500 ETF) and 60% BIL (1-3 month T-bill ETF).

Subscriber feedback drives ALL of this, so keep the suggestions and ideas coming!