November 2, 2023

The latest research, market indicators and trade summaries from Sungarden Investment Publishing

ROAR Score

(Return Opportunity and Risk)

If my choices are stocks and cash, what % would I have the stock market right now?

The current ROAR score is

Market in a Minute

The market always tells us a story…we just need to listen!

1. “I hate when that happens.” An old line made more famous by comedian Billy Crystal on Saturday Night Live in a regular skit called “The Night Watchmen.” That quote was the first thing I thought of as I sat down to write this week’s Market In A Minute.

2. If you read our post last Tuesday, you’ll see why. For a reminder, here is the S&P 500 chart I posted then, showing a down trend in stocks continuing, but with what I called a “gimmie 3% bounce” quite possible. Not a big deal for long-term investors, but the next piece in the market puzzle.

Now, here’s that same chart as of today’s close. Circled, we can see it closed right on the nose. I hate when that happens, because it provides no clarity.

3. But it does make the next week or two a time where hopefully, finally, longer-term decisions can be made with confidence. That applies to stocks, which have perked up suddenly, but as the chart shows, this is the third “call to action” for bulls since September, and it failed to break out the first 2 times.

4. It also applies to bonds. The short end of the bond market (“yield curve”) is still a gift, with T-bills as far out as 12 months still yielding 5.4%. And, while investors acted like they rang Pavlov’s bell, dropping the 10-year Treasury rate from 5.00% to 4.67% in a matter of days, that’s where it stood 2 weeks ago, and 5 weeks ago.

5. My conclusion: Markets are moving fast but getting nowhere. 2023 continues to be a year in which markets have repeatedly failed to commit to a true recovery from 2022’s drubbing. I’ll go into more detail, with some interesting stats, in the premium section of this week’s commentary.

Our ROAR Score remains at 10 for the seventh straight week. But this week, that requires more explanation, other than that it reminds our subscribers that when it comes to investment strategy, I’m a tough grader!

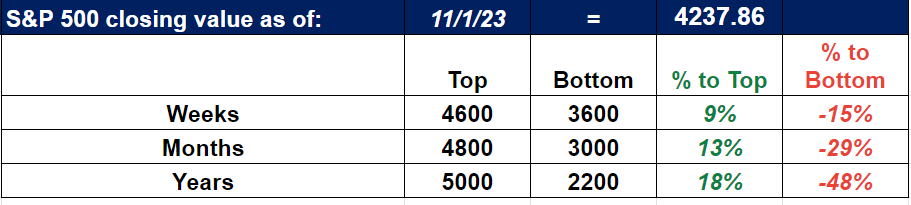

The S&P 500 and 10-year US Treasury Bond, the “big picture” benchmarks for stocks and bonds, are still down in price from when ROAR dropped to 10 on 9/21/23. But it has been in the “red zone” between 0 and 20 since 8/3/23, at which time the S&P 500 was at 4,500 and the 10-year yielded 4.2%.

As luck of timing would have it, this letter comes out on Thursdays and the monthly jobs report is tomorrow morning. Plus, all of that “nonsense” I wrote about above, where the stock market falls for several weeks and then tries to make it all back in a day and a half. So, the most important takeaway for ETFYourself.com subscribers, as self-directed investors, is to understand we are still very much in a “red zone,” at least for the moment.

That said, markets can change quickly in this modern era, and I won’t rule out adjusting the ROAR Score up, or possibly even down, between now and next Thursday’s newsletter. Of course, we’ll immediately send out an interim alert if it changes.

And, if things get really hectic, we will now be using the Notes feature of Substack, so I will be able to “pepper in” more frequent, live observations through that channel, for those that want more of a “stream of consciousness” at times like these.

Our 2-ETF portfolio model is 10% SPY (S&P 500 ETF) and 90% BIL (T-bill ETF).

The 2-ETF portfolio has now outperformed the S&P 500 and the US Aggregate Bond Index by 9% and 15% respectively, since its inception at the start of 2022.

ETFYourself.com is new, but the investment process behind it has evolved over the past 3 decades. You bring the desire, we'll provide the tools!