October 26, 2023

The latest research, market indicators and trade summaries from Sungarden Investment Publishing

ROAR Score

(Return Opportunity and Risk)

If my choices are stocks and cash, what % would I have the stock market right now?

The current ROAR score is

Market in a Minute

The market always tells us a story…we just need to listen!

1. One thing that has been made very clear by the markets since last week’s newsletter: stocks can drop for reasons other than rising long-term interest rates.

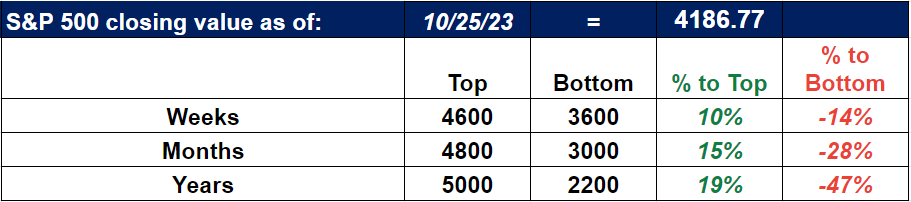

2. In fact, stocks, have been dropping, period. The S&P 500’s year to date gain has sunk from 19% to about 7%. To quote an famous line from the Seinfeld TV show, that’s some real “shrinkage”

3. Long-term bond rates are still way up, with the 10-year US Treasury now at 4.85% versus 3.30% as recently as this past May. Long rates can still go up a lot from here, but I see some early indications that the “easy” money shorting bonds has already been made. We’ll see.

4. There is a “heaviness” to the stock market, and the “sea of red” across my ratings of nearly 200 ETFs still sends a strong message: that equity returns come with massive risk of loss. That’s why our portfolios are so defensive, and the two that can venture into “net short” territory are set up to potentially profit if the slow decline gets more dramatic.

5. This statement from last week’s letter bears repeating (pun intended): Expect high volatility AND opportunity.

Our ROAR Score remains at 10 for the sixth straight week. Our 2-ETF portfolio model is 10% SPY (S&P 500 ETF) and 90% BIL (T-bill ETF). The only reason the ROAR Score isn’t at 0 (all defense, no offense) is that the stock market’s decline is still too orderly. That leaves open a possibility (10% according to the ROAR methodology) that the next move of consequence will be a short, sharp rally. We’ve seen it too many times. And that’s the only difference (and distance) from the current 10 ROAR Score to 0. Let’s see what the coming days bring.

The 2-ETF portfolio has now outperformed the S&P 500 and a 60/40 stock/bond index by 17% and 12% respectively, since its inception at the start of 2022.

ETFYourself.com is new, but the investment process behind it has evolved over the past 3 decades. You bring the desire, we'll provide the tools!