September 28, 2023

The latest research, market indicators and trade summaries from Sungarden Investment Publishing

ROAR Score

(Return Opportunity and Risk)

If my choices are stocks and cash, what % would I have the stock market right now?

The current ROAR score is

Market in a Minute

The market always tells us a story…we just need to listen!

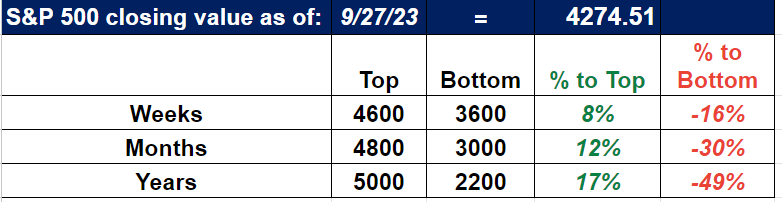

1. The S&P 500's 2023 return through today is 2%. That's not a misprint. I'm referring to the average stock (equal-weighted) S&P 500. The Dow is up 3%.

2. The more popular version of the S&P 500, where stocks are weighted according to size, is up 13%. Why am I doing all of this accounting?

3. Because the stock market is not what it has appeared to be. In future posts, both here and in the media outlets I write for, I'll dive deeper into this.

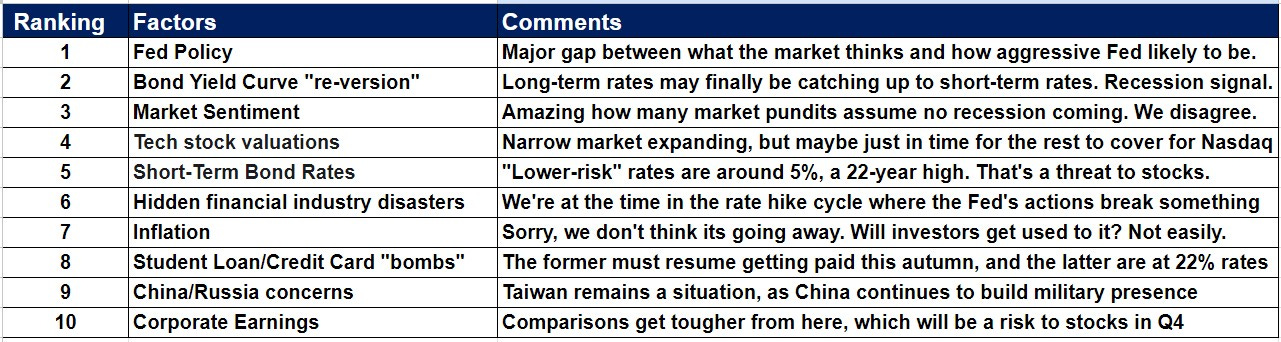

4. We're in the midst of a transition for 2 major market cycles. Bonds generally rose for 40 years, and stocks for 13. In early 2022, both ended.

5. These transitions are an opportunity for investors, not a hurdle. The key is 2-fold: recognition that the changes are occurring, and the tools to capitalize.

Our ROAR Score remains at 10 for the second straight week. Our 2-ETF portfolio model is 10% SPY (S&P 500 ETF) and 90% BIL (T-bill ETF)

ETFYourself.com is new, but the investment process behind it has evolved over the past 3 decades. You bring the desire, we'll provide the tools!