Trump, Biden and the other thing

What investors should really take from last week's debate

I am NOT politically-motivated in anything I write for investment purposes, so that headline is the only mention I will make of the presumptive GOP and Democratic candidates for US President. That debate last week between them has dominated media coverage, and bled strongly into market punditry as well. Because policy in Washington DC does impact markets, especially when it comes to taxes.

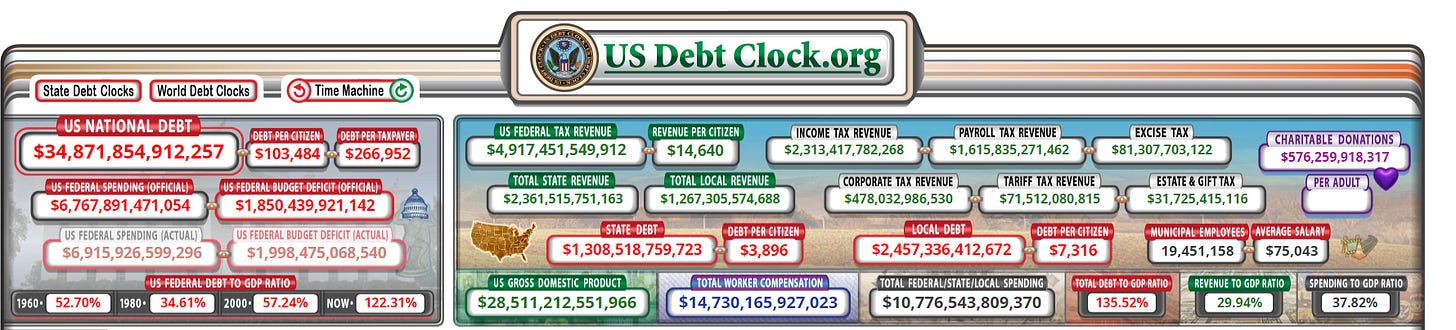

But in addition to the one guy and the other guy everyone is talking about, there’s that other thing. THE DEBT. And one thing that all major US political parties can agree on: we can’t ever have enough of it! That’s how we got here:

That snapshot from this very cool website just does not do it justice. I’m only showing you a fraction of it here, but if you link to or look up USDebtclock.org you can see all the gory details. This actually takes me back to my time as a young Wall Streeter, when I’d pass by the running debt clock on my way to work in Manhattan (New York, not Kansas). But to tackle this debt is not as simple as inflating it away or letting it continue to build, though the latter is the most likely case I think.

The issue is not whether the debt will crush our economy and the proverbial chickens will come home to roost, destroying the US Dollar’s supremacy and throwing the world economy into a great depression. I can’t possibly predict anything like that with accuracy.

But what I can conclude is that this will increasingly constrain the ability of whoever is in charge of the US Congress (which ultimately governs the spending) to enact growth-oriented policies. THAT is the intermediate term to long-term risk. Not the debt we have, but how it limits economic growth potential, which in turn weighs on the stock market.

So as it turns out, 2025 might be a rough year for whomever gets the job.

How about that Emma! Thanks to her, we did not skip a beat last week while Dana and I were out. Emma and I are recording a series of video education sessions this week and next, covering these topics:

Modern markets and why they are different

Investment risk management

Building a “toolkit” to manage a portfolio yourself

Introduction to YARP™ dividend investing

We will add additional and timely recorded sessions to these once they are finished. And we’ll have some live sessions to help answer questions subscribers have from these videos, as well as walking folks through how to better understand both ETFYourself.com and the SungardenInvestment.com service, so each investor can apply it as they see fit. We are quite excited about this education project, and I thank Emma for her leadership on it!

Sungarden Mailbag

Finally for today’s free section, I had a great set of questions sent to me through our chat by a new subscriber. So here is a shortened version of that Q&A, which I think many who follow us will benefit from reading.

Q: I fear big losses, so how does your service help me try to avoid that?

THAT is why we created this service. To provide a process so that investors can look at markets that others consider to be rough (because they think stock/bond prices up=good, but prices down=bad). This is what I have essentially rebelled against for 30 years.

Most of that time it was as an advisor to families (where I was a "fiduciary" and managed their assets directly, with customization and personalization) and now for a few years via the research/publishing approach (i.e. here's what I'm doing, you decide what you are going to do). ETFYourself.com is the "mainstream" version of my teaching investors structure and process, using only ETFs as the tool set, and providing market commentary and technical analysis that helps lead to my own portfolio decisions. So yeah, it is all about CONFRONTING AND EXPLOITING markets that don't always go up...because they don't.

Here is more on that concept, and how we implement it at a high level in this service:

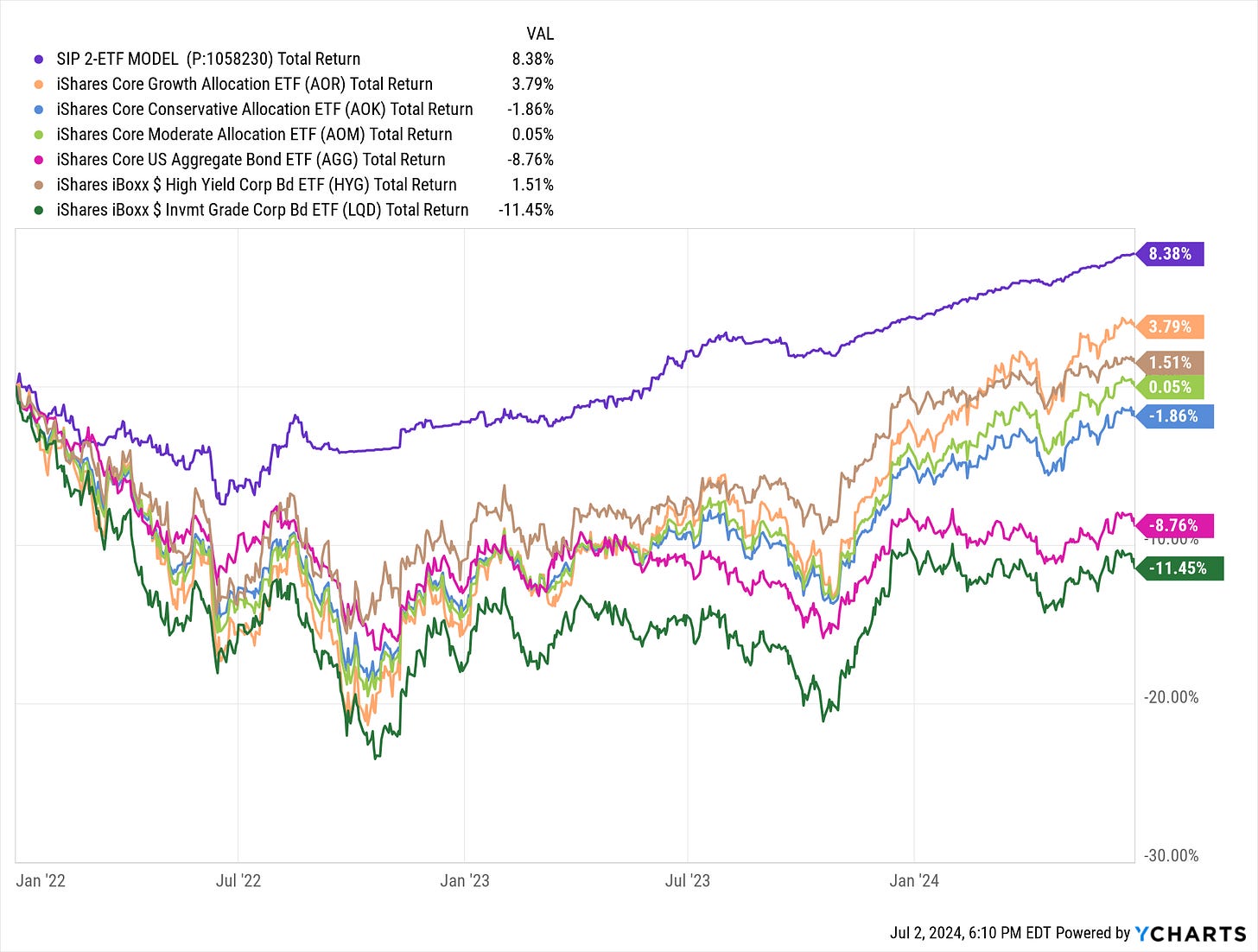

ROAR Score and the 2-ETF portfolio: an update through mid-year

This is an updated picture of the simple but effective 2-ETF portfolio I run, the basis of which is the ROAR Score that essentially says “how much risk am I willing to take right now to pursue reward?” It fluctuates between 0 and 100, and this 2-ETF portfolio tactically allocates between a pair of ETFs, SPY (S&P 500) and BIL (1-3 month T-bills).

This portfolio just reached the 2 1/2 year mark, and it is fair to say we are pleased with its progress. NOT because it happens to have outperformed a wide range of traditional asset allocation portfolios and bond types, but because it shows how so much of investment success is striking a healthy balance between “greed and fear,” erring on the side of caution, and remembering that our goal is not to “beat the market” but to keep the account balances moving up as often as possible. One good way to do that is to not lose big when our neighbors are.

Q: How does the 7-ETF portfolio in ETFYourself.com differ from the Institutional portfolio at SungardenInvestment.com?

This might be the most common misperception among our current subscribers, so let’s clear it up here. My investment approach has had the same objectives (avoid big loss, then make as much as I can, but risk management comes first) since the 1990s.

What has changed is the tool set we investors are able to use, and how markets have evolved. So the 7-ETF portfolio might be what some consider to be "new" but it is really just a very constrained version of the CORE portfolio that is 40% (largest segment) of the service at SungardenInvestment.com. That CORE portfolio has a long-term record, audited through the time I was an advisor, and since that time, it reflects my personal portfolio.

Since folks used to pay a 1% advisory fee and our average client size in those days was $2.5mm, we had to figure out how to provide the investment piece of it to a wider audience, minus the personalization, trading, and supervisory responsibilities of an advisor. The 7-ETF portfolio tries to do that by providing 2 of the basic pieces of the process: the depth chart (7 ETF position slots, each with 7 ETFs to choose from in each of the 7 slots, so that 1 of the 7 is owned at a time) and the portfolio itself. I have run that for about 9 months.

So, are the 3 strategies at SungardenInvestment.com "better” than the 7-ETF model at ETFYourself.com? They are just different, and more flexible, since the Sungarden Investment.com service is a higher-priced offering.

Q: Do you offer a trial version of the Institutional service, like you do for ETFYourself.com?

We decided not to, at least for now. Instead, we opted for something we think was, frankly, pretty altruistic. I have been posting the trade alerts, minus the specifics, to anyone who signed up for the free version of the SungardenInvestment.com service. Not to tease people, but to give them as much of the experience of that version of what we do, without being unfair to the folks that do pay $300 a month.

Q: Will you offer part of the Institutional service “a la carte?” For instance, for someone who is only interested in following the Core ETF portfolio or the YARP dividend portfolio?

The answer is nearly YES. We are just determining how best to do that. That is something we will cover in the first of the upcoming meetings.

Remember, this is a "second career" for Dana and me, as we retired in 2020 when we sold our advisory business. But this iteration of Sungarden, as a research service/not personalized advisory, is really about seeing if and who wants to learn from my experience from here forward.

I think I am innovating as much as I ever have, especially in the dividend income area (YARP portfolio at SungardenInvestment.com) and we aim to identify the people who want to come along on this semi-retirement investment education/research/decision-making journey with us.

From there, we can price it in a way that people feel they are getting value, and that they can have a "growth path" within the service. We know there's a big gap between $400 a year for ETFYourself.com and $3,600 a year for the Institutional service, and we want those who want to go beyond ETFYourself.com's intentional limitations to help us figure that out.

So we encourage subscribers to give us an idea of what they might be interested in. We have developed a steady following at different levels of interest (free, ETFYourself, SungardenInvestment), and the more we know about what our existing group of followers and subscribers wants, the better and faster we can deliver the uncommon value and experience we set out to when we started this 9 months ago.