Monday, August 5, 2024 might be remembered for a long time. Or, it will fade into the long list of “near misses.”

As the late great comedian George Carlin said about that expression when it involved a pair of a commercial airplanes, “it’s a near hit, gang.”

We’ll see which one Monday was. First, let’s get through Tuesday and the rest of the week. And the month. Because regardless of what happens next, there are a handful of things that Monday reminded me of. After 38 years in the investment industry, I have a lot of memories.

It is ALWAYS time to manage risk

But my “bread and butter” is volatility, market selloffs, and navigating through markets that get suddenly dangerous. So, this is no time to wax poetic about whether the Fed was late, if Japan is a real issue, or if there’s a hedge fund that just blew up and we’ll hear about it soon.

Despite everyone from Cramer on CNBC to Oppenheimer and several other brokerages screaming “buy the dip,” I just don’t see it.

Over a trader’s time frame, of course. We could see the 8-10%+ declines in stock indexes reverse tomorrow. Then again, I’m not paid to be forever bullish like most people in the investment business!

Others can debate the reasons all they want. That’s not my concern. The actions to take are my priority. And I’m taking decisive action, while leaving room for anything to happen. “Offense and defense at the same time.” That’s the approach here.

If you have been following my work for even just a few weeks, or listened to our 4-part video series we posted recently, you know that “not losing big” is something I prioritize at all times. But this summer, as in many past market declines, having those priorities in order is leading to higher portfolio values at a time when a lot of investors are searching for a way to stop the red ink from flowing.

The goal now is to see if the market provides a historic opportunity to not just defend this pullback, but EXPLOIT IT. And without a doubt there are shades of the 1987 crash and the 2000 dot-com bubble bust in recent market price action. And while it may not turn into anything other than another temporary scare for investors, I for one NEVER underestimate what market can do to enhance AND destroy wealth.

Sungarden Institutional Portfolio: recent tactical moves

Over the last several days, I’ve:

Trimmed stock positions (which were already a bit lighter than normal), taking profits on REITs, Utilities and other narrow parts of the market that have actually surged recently

Increased allocations to ETFs that own US Treasury securities, effectively “lengthening” maturities beyond my previously “T-bill happy” posture

And on Red Monday, as uber-bulls on Wall Street were continuing to act as if nothing bad could ever happen in the markets (see title of this post), I swapped a pair of put option contracts which are a key part of the “defense” plan I have used for years.

And while “defense” is their primary objective, when the very scenarios they are used to defend against come to pass, and gains of 150% and 189% since their initial purchases back in May have been earned, these small but powerful positions go a long way toward offsetting risk I’m taking elsewhere in the portfolio. I explained the details and showed the trades I made to our paying subscribers earlier today, right after I made the trades in my own account.

The more “cookie-cutter” 7-ETF model portfolio maintained as a learning tool at ETFYourself.com has held in well, off just over 1/4 of what the S&P 500 has lost since mid-July. Tuesday is our usual weekly review of that mix, reported to paid subscribers to that service.

What’s next for the markets?

The primary trend is down for stock prices and up for bond prices. You didn’t need me to tell you that. However, the market is getting so “binary” and volatile, there’s no need to “get cute” here. So I am looking for ways to simplify things even further. The bottom line is this:

Modern markets continue to squeeze the art out of “investment management” and what we are left with is the science:

Offense and defense, co-existing under the same portfolio roof

Less time spent looking for “that next great stock” or ETF

Tactical maneuvers as the main engine of growth and preservation

Dividend income is great…UNLESS it comes at the risk of steep price losses

It takes a “village” of investment vehicles: stocks, ETFs, T-bills and options

1987 versus 2024

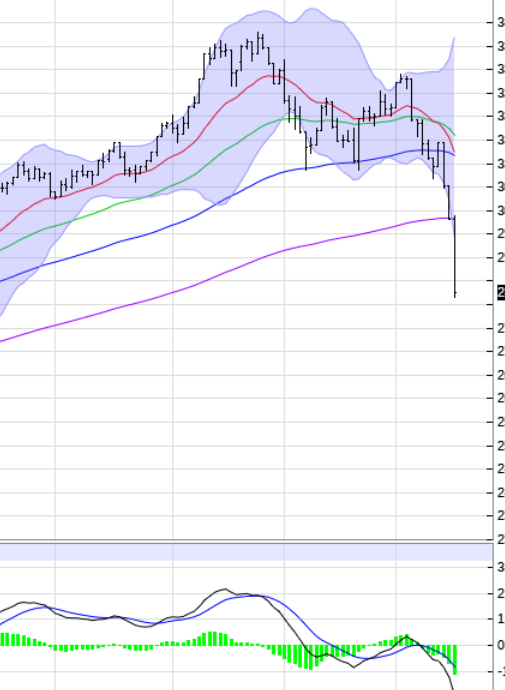

Finally, as they say, I’ll just leave this here. The top chart is 1987. The bottom chart is the current market. Right now, as of Monday’s close.

I’ve charted for 44 years, and since most people haven’t, here’s what I’m watching to see if this “gets real in a hurry.” Watch the moving averages, which are the color lines (20-day = red, 50-day = green, 100-day = blue, 200-day = purple).

In 1987 and other flash-declines (2000 had a pair, 2020 had a big one thanks to Covid), the red line dropped suddenly through the green, then quickly sliced through the blue and then the purple. That’s a way of saying that a calm trend broke down so quickly, the dip buyers were fooled, then whiplashed, then shellshocked.

This first chart shows what happened leading up to the 1-day, 22% drop in the stock market on October 19, 1987. I was a Wall Street rookie and I’ll never forget it. And I’ll never forget to do everything I can do avoid having my own accumulated wealth ever be subject to those types of collapses. That’s lifestyle-changing stuff.

Lately, a similar script is playing out. I don’t predict the future, I just prepare for as many possible outcomes as I possibly can. I’m not only prepared for this one, I am ready to pounce on it if it follows through.

Learn more

So if you haven’t checked out the free 4-part video series Emma and I posted recently, please do. And if you want to learn more about the Sungarden Institutional Service, where I “show my cards” and process every day, let us know.

Best regards,

Rob Isbitts

Founder, Sungarden Investment Publishing LLC