YARP™: How it started, how it's going

My "dividend" portfolio is getting battle-tested every day. What we've learned so far.

First, why am I providing a performance update on the YARP portfolio, just over 4 months since we initially started tracking its returns for SIRG subscribers? Because as early 20th century comedian W.C. Fields famously said “I once spent a year in Philadelphia, I think it was on a Sunday.”

The stock market is not open on Sundays, of course. And I have no issues with Philadelphia. In fact, Independence Hall is one of my favorite places to visit.

A lot of days in the stock market recently have seemed like weeks, if not months or years. Volatility is high, and thus the opportunities abound. If you have a risk-managed approach to it.

Now, after days like Tuesday, a lot of investment folks like to send emails out like this one I received in my inbox:

I did not identify the source, because that makes it easier to say this: that is a completely ignorant and unnecessary way to approach rough-and-tumble markets. And it is why I like to skip the fear tactics, and instead use data and explain the data.

Because the YARP portfolio focuses primarily on dividend stocks, it would be easy to assume that, like other dividend-driven strategies, it simply melts down when the stock market does. But for folks like me who treat investing as more than a contest, since it is my own retirement involved, the goal is ALWAYS to manage risk first, then grab as much dividend income and price appreciation as possible.

That’s why, as with the CORE ETF portfolio I’ve run for more than 20 years in different forms, my “calling card” as an investor has always been to play offense and defense at the same time. And that at least opens the door for what we’ve seen the last 4 months from YARP.

I ran a version of YARP as a sub-advised mutual fund and as a separately-managed account back during my years as an investment advisor. But as I explained on multiple podcast appearances and articles this year, I brought it back in a form built for modern investment markets. Specifically:

40 stocks, owned at positions of 1% to 5% at any time.

Those 40 stocks are replaced one by one, but the stock turnover is not very high

What IS high is the degree to which I ROTATE among that 40 stock mix

That’s one way I manage risk and “goose” as much yield as I can from those stocks

The other way is to supplement that stock portfolio with options and ETFs

That way, there’s a potential “hero” when markets run “hot” in either direction

While there is often little to learn from just 1/3 of a year of investment returns, I did a quick little study on how my own live-money YARP portfolio has done since we officially started tracking it in its current form on May 1 of this year. The returns are summarized, then detailed below.

TAKEAWAYS

While this is still a very limited sample size (76 trading days), I think it shows 2 things:

YARP has benefitted by the recent outperformance of certain sectors. Of course, that was not an accident. My charting led me to those sectors and stocks.

Risk-management is NOT something to figure out when markets are shaking. It needs to be a proactive, ever-present part of the investment process. That’s what I have practiced for decades, and the recent success of YARP in up and down stock markets tells me more about the PROCESS and STRUCTURE of what I do here than what the market has done lately. Because, as I’ll show later in the week, the same principles applied to an even more risk-managed portfolio, CORE ETF, have shown similar capabilities to YARP, but over a much longer period of time.

As for the recent results, I think they fit the category of “this doesn’t just happen.”

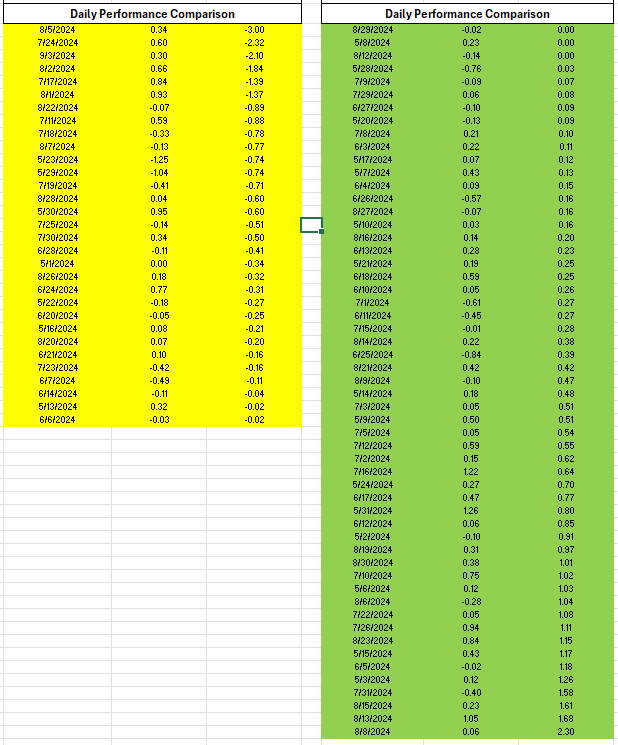

I divided the S&P 500’s daily performance into 2 buckets: yellow shows the down days and green shows the up days (0% return was grouped with the positive returns). I’ve done this type of analysis for decades, mainly to stress-test my own work. And it has been valuable in navigating those rare times when markets fall or rise very quickly.

As shown in yellow below, YARP actually managed a positive return over those 6 weeks’ worth of S&P 500 down days. What I find remarkable about this is the coincidence it has to how CORE did when the pandemic first started to strike the stock market in early 2020. Back then, it was a 33% drop in the S&P 500 in just 5 weeks, but CORE gained 2.5%. If we really want to extend this out, the returns for YARP in yellow, which came in 31 days, and remembering that the stock market is open for about 250 days a year, implies that the annualized return for YARP during those yellow days is about 20%.

Since I am a risk manager and not a magician, the green section below on the right shows that the S&P 500’s up days have been very strong. 45 days, 32%. That’s pretty aggressive, and reflects the whipsaw nature of the stock market since May. YARP gained about 1/4 of that, which I would not be happy with if it was in a straight up market. But as you can imagine, it is the combination of the ups and downs that is ultimately the key here.

YARP is not designed to track the S&P 500 step for step in the market’s best times. Not with risk management at the top of the mission list.

That said, through this past Tuesday, with YARP up on another big down day for the S&P 500, YARP has now outpaced the market index since 5/1/24, as shown here.

That won’t always happen, but I’m glad to remind myself that it is possible. A lot of dividend-driven portfolios can only do that if the stock market is driving higher. In other words, they have no plan to play defense, other than the assumed defensive nature of dividend stocks.

As for me? I’d rather have defense built into the process. Dividend ETFs and stock portfolios can get crushed just as easily as the S&P 500 can. So I’d rather have a built in safety net, and the ability to maneuver as market trends shift.

This last chart is admittedly another case of a small sample size, but since we have already seen SPY fall by nearly 8% in a 20-day period, I think this picture indicates there is something different going on. I know it is because this is how I run my own money. But since we have attracted a new and growing audience, I felt that this first 4 months provided a hint of what YARP is capable of.

One thing to keep in mind, given the cheery YARP numbers above: when things are not going as well, or when I am just plain lousy for a period of time, you’ll know. Because I’ll be pointing it out. Successful investors learn a lot more from what goes wrong than right.

I do expect YARP to be at least competitive with the S&P 500 over any longer-term period in which the stock market’s return is in the single digit percentage range. In other words, a 5-year annualized return of 15-20% for the stock market is not something I expect to come close to. But during a combination of up and down markets, not only over days, but months, quarters and years? That’s a fair fight for YARP. And even to some degree for CORE. I’ll have more on that in an upcoming post.

Don’t forget to sign up for tomorrow’s live session:

CORE ETF: PORTFOLIO UPDATE & ENHANCEMENTS

Thursday, September 5 at 4PM ET

Don’t miss any posts! Subscribe here for Sungarden Investment Publishing